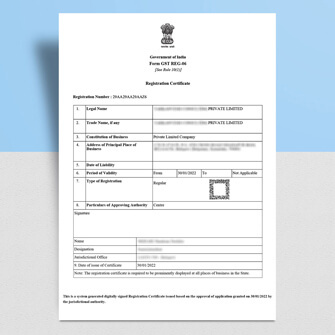

GST Registration

50% off ₹2,000 ₹1,000

Regular Price : ₹2,000

Our Price : ₹1,000

End-to-End Assistance* for GST registration and ensure to have harmonious process for Invoicing, E-invoicing and filing through software.

Reach Our Expert

Lorem ipsum dolor sit amet

onsectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud

Consectetur adipiscing elit

pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Commodo consequat

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet

onsectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud

Consectetur adipiscing elit

pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Commodo consequat

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

USP-2 Necessitatibus eius consequatur ex aliquid fuga eum quidem

Lorem ipsum dolor sit amet

onsectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud

Consectetur adipiscing elit

pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Commodo consequat

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet

onsectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud

Consectetur adipiscing elit

pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Commodo consequat

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

GST Registration FAQ's

A Goods and Services Tax (GST) certificate is a document issued by the Indian government that certifies that a business is registered with the Goods and Services Tax (GST) system. It is a unique identification number that is used to identify a business for taxation purposes in India.

There are many factors to consider when answering this question including how well you operate your business. We encourage you to connect with our current franchise partners regarding their experiences.Any business that is registered for GST with the Indian government must have a GST certificate. This applies to both online and offline businesses.

Yes, in India, businesses must obtain a GST certificate in order to be registered for GST. Without a GST certificate, businesses will not be able to charge GST on the goods and services they sell.

Businesses with an annual turnover of more than Rs. 40 lakhs are required to register for GST. However, this limit is lower for businesses in certain special category states, such as Arunachal Pradesh, Manipur, and Nagaland. Also, there are different rules for businesses involved in e-commerce, which may have to register for GST regardless of their turnover.

Read our article to find more details on turnover limit for GST Registration.

No, only persons registered under GST are allowed to collect GST from the customers. A person not registered under GST cannot even claim the input tax credit on the GST paid.

We Provide

Best Quality Services

GST Registration

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

GST Return Filing

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

GST Consultation

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

Income Tax Return Filing

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

Income Tax Consultation

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

Partnership Registration

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

Business Registration

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply

GST Notice

₹ 1270 / Excl GST

Apply for New GST by online Registration with Kanakkupillai! Without Visiting the Govt. office, get your GST Registered in India in just seven days.

* T & C Apply