GST Return filing

25% off ₹750 ₹1,000

Regular Price : ₹1,000

Our Price : ₹7,50

File a GST monthly return with high level of reliablilty and accuracy, 2 stage gst return filing for regular dealer.

Reach Our Expert

Data collection

Client will be communicated for sending data required for GST filing, client is required to send data in the prescribed mode as already communicated to them.

Validation of data

All the data collected will be validated for correctness and accuracy.

Filing GSTR-1 return

Invoice wise datails will be submitted in GSTR-1 return along with credit notes, ammendments etc.

Filing GSTR-3B

After cut off date for generation of GSTR-2A input tax credit report, GSTR-3B return will be processed and tax liability if any will be communicated.

Payment of tax

Client will be communicated with the amount of net tax , late fees and penalty if any payable and payment shall be made from their net banking account or through NEFT or RTGS.

Final submission of GST return filing

Once GST tax payment is made all the details will be re-verifed before submitting the GST return by OTP authentication.

Why Choose Right auditor for GST return filing in Chennai

Two stage filing

We understand that two stage filing is must for all clients who have outward supplies during the month, it ensures efficient use of input tax credit and timely transfer of input tax credit to other registered dealers, therefore we always prioritize two stage filing by filing GSTR-1 within due date and filing GSTR-3B after input tax credit auto-populated.

Grip over Client GST filing history

We ensure to assign same staff for monthly GST filing for consecutive months, this ensure that GST filing history and nature of data, corrections required is well aware even before taking up the current month filing. Deployment of same staff provides additional layer of reilability.

Up-to-date GST knowledge

With continous learing, updating with latest rules and procedues in GST laws our GST filing service is bullet proof for its quality and long term compliance.

Savings in GST penalties and late fees

Continous reminders and timely communciations are sent for periodical GST filing which provides peace of mind to comply with due date and saves penalty and late fees to our clients.

Periodical review

We conduct periodical review of GST login for presence of any GST notices, or any other defaults to ensure timely action is taken.

GST filing FAQ's

In GST monthly return filing scheme, statement contatining details of outward supplies, credit notes, ammendments etc is submitted in form GSTR-1 on or before 11 th of succeeding month, after 13 of each month GSTR-2A is generated to verify the input tax credit available for the month, and there after final return after payment of tax or any other amount GST return is submitted.

QRMP scheme means quarterly return and monthly payment scheme, in which payment of tax is required to be made for each month and return can be filed quarterly. This scheme is not much beneficial because it involves duplication of work, preparation of data for monthly payment of tax and once again during quarterly filing.

If GST return is not filed for continous period of 6 months the concerned GST officer can issue show cause notice for cancellation of GST registration, failure to file GST return further will result in Cancellation of GST registration.

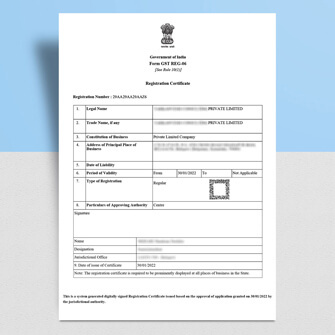

GST first return is GST return which is to be filed in first period after grant of GST registration certificate, attention to GST first return is crucial where GST registration is applied in case of mandatory clause by crossing treshold limit.

Read our article to find more details on turnover limit for GST Registration.

Filing of GST return is not allowed without payment of taxes, filing option will be enabled only after GST liability is paid.

We Provide

Best Quality Services

GST Registration

Apply GST @ ₹ 2000

Apply for New GST by online Registration with Right Auditor!, get your GST Registration ARN number in 1 day.

* T & C Apply

GST Return Filing

Starting From ₹ 500

File monthly GSTR-1 return and GSTR-3B return on time, with accurate data, we assure efficient data processing for GST monthly return filing.

* T & C Apply

GST Consultation

Starting @ Rs.1000

Get advice from professional GST consultant for GST notices, demands, and other proceedings under GST Act.

* T & C Apply

Income Tax Return Filing

₹ 1000 Onwards

File your income tax return with best income tax consultant in Chennai, get maximum tax benefits under Income tax Act.

* T & C Apply

Income Tax Consultation

₹ 1000 Onwards

Professional advice for income tax notices, income tax demands, and other advanced income tax compliance.

* T & C Apply

Partnership Registration

Complete package @ ₹ 5000

Get professionaly drafted partnership deed, PAN number applcication and partnership registration certificate issued by registrar of firms.

* T & C Apply

Business Registration

Starting from ₹ 1000

Register your proprietor business, partnership business and private limited company in Chennai for your new business.

* T & C Apply

GST Notice

₹ 1000 Onwards

Get the support of professional and knowledgeable GST expert for dealing with GST notices and other GST issues.

* T & C Apply