GST Registration

33% off ₹3,000 ₹2,000

Regular Price : ₹3,000

Our Price : ₹2,000

Apply GST registration in Chennai for new business or existing business, highest approval rate for GST registration application in Chennai.

Reach Our Expert

Highest GST registration application approval rate

From the time a prospect approaches us for GST registration, we guide them with appropriate documents and suggestions for fast approval, we believe every application can be approved if proper documents and procedures are followed

Complete GST services

Starting from Consultation for GST registration, we provide GST return filing services, handling GST notices, and advanced tax planning services.

Execution of GST assignments on long term perspective

Every work we undertake will be executed in line with GST act, we do not favour improper practices as it may bring up heavy penalties and consequences, long term complaince is our key quality control manthra.

Steps in GST registration

Step 1 : GST registration consultation

As a commitment towards reliablity, discussion with client is held to confirm wether GST registration is really required legally or in practical aspects, this saves clients from application for GST registration without any uses and saves them from unnecessary compliances.

Step 2 : Documentation

Clients are adivised regarding documents required for their application, suggestions and recommendations are provided for preparation of valid and right documents for fast approval.

Step 3 : Online GST registration application filing

GST registration application is submitted with necessary documents and relevant details in GST online portal.

Step 4 : Aadhaar authentication.

For fast approval without physical verification of business premises, GST registration application should be verified using OTP received using Aadhaar number.

Step 5 : ARN number generation

Application reference number also called as ARN number is reference number used for tracking the satus of application, time limit is calcualted from the date of generation of ARN number, therefore if ARN number is not generated it will not be processed by department.

Step 6 : Application tracking and approval

After ARN number is generated application status will be tracked, once approved GST certificate and other guidance will be provided.

What should I know before getting GST registration ?

GST registration mandatory if turnover exceeds treshold limit.

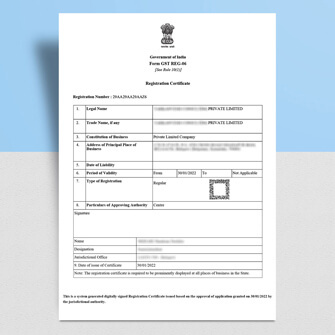

GST registration is mandatory if turnover exceeds Rs.40 lakhs for traders and for service providers the limit is Rs.20 lakhs, once treshold limit is reached application for GST number should be submitted within 30 days in FORM GST REG -01 through GST online portal

No turnover limit for certaion buiness

GST registration is required to be applied if the dealer is engaged in any of the forthcoming activty such as interstate sales, import and exports, carrying on the business using the brand name of others.

All rule applies to voluntary registration

Once GST number is approved for the dealer on appication as voluntary taxpayer, all the rules applicable to regular dealers are applicable, therefore all returns and forms are required to be filed with in due date. Voluntary registration is suggested only when there is tax savings or where business cannot be carried out without GST number in practical business environment

GST composition scheme

GST composition scheme is liberal scheme for small dealers whose turnover is up to Rs.1.5 crores for trading in goods and Rs.50 lakhs for dealer providing services. In composition scheme fixed percentage of tax is required to be paid without availing input tax credit, composition scheme should be opted in registration applcation itself, it cannot be opted after registration and up to end of financial year.

Cancellation of GST registration on application by tax payer

When GST number is not required, it is recommended to apply for cancellation of GST number and file form GSTR-10 with in time limit to avoid rejection of new GST number in future.

GST Registration FAQ's

GST registration certificate is valid as long the certificate is cancelled by the GST officer or cancelled on applicaition by the taxpayer.

Yes, in case of there is additional place of business such as branch within the state of existing GST registration, additional place of business shall be added to the existing GST registration through ammendment application.

It is not mandatory for the officer to issue GST registration number after physical verification of business address, however in the case of failed aadhaar validation or aadhaar validation is not opted then inspection of business premises will be assigned, therefore GST number will be alloted only after verification of business premises.

GST registration is based on value of taxable services or goods on all India basis, so therefore if the entity crosses the treshold limit on all India basis then GST registration is applicable for trading only in exempted goods in any state.

Read our article to find more details on turnover limit for GST Registration.

Where principal place of business is in more than one state, seperate GST number should be applied for each state, there is no concept of centralised GST registration number on all India basis. Centralised GST registration number can be taken only for headoffice and branches located in the same state.

We Provide

Best Quality Services

GST Registration

Apply GST @ ₹ 2000

Apply for New GST by online Registration with Right Auditor!, get your GST Registration ARN number in 1 day.

* T & C Apply

GST Return Filing

Starting From ₹ 500

File monthly GSTR-1 return and GSTR-3B return on time, with accurate data, we assure efficient data processing for GST monthly return filing.

* T & C Apply

GST Consultation

Starting @ Rs.1000

Get advice from professional GST consultant for GST notices, demands, and other proceedings under GST Act.

* T & C Apply

Income Tax Return Filing

₹ 1000 Onwards

File your income tax return with best income tax consultant in Chennai, get maximum tax benefits under Income tax Act.

* T & C Apply

Income Tax Consultation

₹ 1000 Onwards

Professional advice for income tax notices, income tax demands, and other advanced income tax compliance.

* T & C Apply

Partnership Registration

Complete package @ ₹ 5000

Get professionaly drafted partnership deed, PAN number applcication and partnership registration certificate issued by registrar of firms.

* T & C Apply

Business Registration

Starting from ₹ 1000

Register your proprietor business, partnership business and private limited company in Chennai for your new business.

* T & C Apply

GST Notice

₹ 1000 Onwards

Get the support of professional and knowledgeable GST expert for dealing with GST notices and other GST issues.

* T & C Apply