Partnership firm registration

33% off ₹9000 ₹6,000

Regular Price : ₹9,000

Our Price : ₹6,000

Register your partnership firm with one of the reputed partnership firm registration,tax and business advisor.

Reach Our Expert

Affordable

Partnership firm is considered to be affordable to register and maintain, the cost of registration and compliance is low while advantages are high.

Minimum compliance

There are fewer mandatory compliances like, income tax filing, annual filing etc, unlike private limited company parnteship firm is not required to maintain voluminous documents.

Optimised advantage

Partnership firm have integrated benefits of proprietorship and private limited company, in most cases we recommed partnership registration for new start up business for its flexibility to add partners, flexibilty to ammend terms, easy documentation etc.

Easy set up

Partnership firm is easy to set up, in 99 % cases desired name can be obtained without any rejection, quick approval by department with minimum documents. Partnership firm can be set up in as quick as in 2 working days, no approval are required for partnership deed approval, approval is required only for firm registration certificate.

Benefits under income tax act

Benefits of 44AD presumptive taxation is applicable to partnership firm, therefore partnership firm also given benefits of minimum documentation under income tax act. Tax audit is not mandatory for partnership firm therefore partnership firm enjoys same benefits as proprietor ship firm.

Steps in partnership firm registration

Step 1 - Business registration consulting

Client requirement for business registration is gathered, discussion with client is held to validate suitability of partnership firm registration, over other forms of business.

Step 2 - Partnership deed drafting

Once partnership registration checklist is received from client, partnership deed is drafted and sent to client for approval and any corrections.

Step 3 -Submission of firm registration application

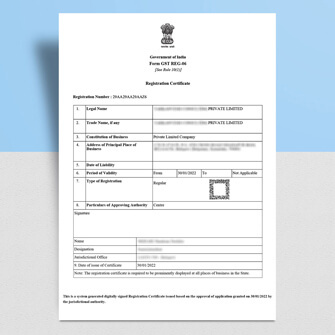

Once deed is approved partnership deed is printed and firm registration application is generated for signing by all the partners and witness. On receipt of signed application with relevant documents, it is submitted to registrar of firms for approval of partnership firm registration certificate.

Step 4 -Pan card application

Pan card application is submitted to income tax department for allotment of PAN.

Step 5 -Tax and other advisory

Once the certificate is received client will be advised regarding due dates, basic tax advisory for compliance, renewal dates etc.

Partnership Registration FAQ's

Partnership firm registration certificate is issued by the registrar of firm of concerned region, partnership registration certifcate is government document aknowledging entry of firm name in register of firms.

No registration of partnership firm is not mandatory, however partnership registration certificate is required at the time of opening bank account, application for business loan, application for tenders, vendor empanelment etc.

There is no such concept of renewal of partnership firm, however annual return should be filed every fiancial year, delay in filing of annual return results in penalty.

Partnership firm can be registered at residential address also, there is no such condition that firm should be registered only at commercial address.

Yes, more than one partnership firm can be registered with the same name, if we need to protect our business name from other persons then it is recommended to apply for trademark.

We Provide

Best Quality Services

GST Registration

Apply GST @ ₹ 2000

Apply for New GST by online Registration with Right Auditor!, get your GST Registration ARN number in 1 day.

* T & C Apply

GST Return Filing

Starting From ₹ 500

File monthly GSTR-1 return and GSTR-3B return on time, with accurate data, we assure efficient data processing for GST monthly return filing.

* T & C Apply

GST Consultation

Starting @ Rs.1000

Get advice from professional GST consultant for GST notices, demands, and other proceedings under GST Act.

* T & C Apply

Income Tax Return Filing

₹ 1000 Onwards

File your income tax return with best income tax consultant in Chennai, get maximum tax benefits under Income tax Act.

* T & C Apply

Income Tax Consultation

₹ 1000 Onwards

Professional advice for income tax notices, income tax demands, and other advanced income tax compliance.

* T & C Apply

Partnership Registration

Complete package @ ₹ 5000

Get professionaly drafted partnership deed, PAN number applcication and partnership registration certificate issued by registrar of firms.

* T & C Apply

Business Registration

Starting from ₹ 1000

Register your proprietor business, partnership business and private limited company in Chennai for your new business.

* T & C Apply

GST Notice

₹ 1000 Onwards

Get the support of professional and knowledgeable GST expert for dealing with GST notices and other GST issues.

* T & C Apply