GST registration application approval time limit is based on multiple factors such as submission of correct documents, Aadhaar E-KYC, and responsiveness of the officer.

GST registration application is completely made online from the beginning, therefore immediately after the generation of the ARN number the processing of the application will be assigned to the respective jurisdictional officer.

TRN number – Temporary reference number created after creating a temporary login for GST registration, it is valid for 15 days from the date of generation

TRN number is used for logging in to the GST registration portal gst.gov.in through OTP.

ARN number – Application reference is generated once all the process required from the applicant is completed, the time limit for the officers is calculated from the date of generation of the ARN number.

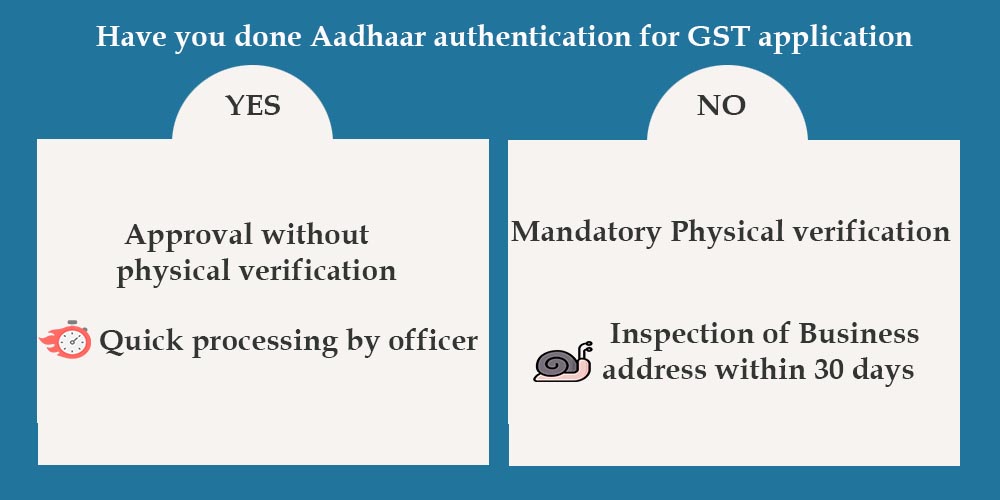

Processing time for GST registration application by the GST department will vary according to the Option of Aadhaar e-KYC by the applicant

Time required for GST registration when Aadhaar validation is completed online

After submission of the GST registration application, the link for Aadhaar E-KYC will be shared with the applicant via registered e-mail ID.

Once Aadhaar e-KYC is completed using OTP received in registered mobile number with Aadhaar, ARN number will be generated and officer will issue GST registration certificate or issues notice seeking additional information within 7 working days.

If notice is issued, response to the query should be made within 7 working days by the applicant

On receipt of response, application will be approved or rejected by the officer with in 7 working days after submission of reply.

Therefore, time limit for approval of GST registration after ARN number generated in case of Aadhaar validation completed is 1-21 working days depending on time taken by the applicant and the officer.

Time required for GST registration when Aadhaar validation is not opted or completed

In case Option of Aadhaar KYC is opted and not completed within 15 days from the date of submission of application, ARN will be generated after expiry of 15 days.

If the option to Aadhaar validation is opted during submission of application, ARN will be generated after submission of application.

The officer will issue GST registration certificate or issues notice seeking clarification with in 30 days from the date of generation of ARN.

In case a query is raised, applicant need to respond within 7 working days, and the officer will approve or reject within the next 7 working days.

Therefore, maximum time limit if Aadhaar e-KYC is not opted is – 30 days + 14 working days.

Maximum time limit when Aadhaar e-KYC is opted and failed – 15 days + 30 days + 14 working days.

It is advised to make sure to complete Aadhaar e-KYC if option is selected as soon as possible.

How to get Quick and easy approval of GST registration

- Use Aadhaar e-KYC functionality to reduce considerable time required for inspection.

- Link Aadhaar card with mobile number so that E-KYC can be completed, and we can get response from the officer with in next 7 working days, so we can save 20 – 23 days for initial response from the officer. Therefore, if everything is correct and officer is satisfied, application will be approved within 7 working days.

- Make sure name as per PAN and Name as per Aadhaar is same before opting for Aadhaar e-KYC, this can be ensured using the income tax profile section. Therefore, if name is validated, inspection can be avoided by option to Aadhaar e-KYC.

- Complete E-KYC asap to reduce the time limit of 15 days for generation if ARN.

- Submit neat and clearly scanned documents.

- Get assistance of GST registration consultation for submission of proper documents.

- In case rental agreement is attached as a business proof make sure it is valid, business address as per the rental agreement, filled up details, address as per utility receipts are same.

- Make sure address mentioned for property owner of the business address is as per Aadhaar, because as per our experience is some case Aadhaar copy of the property owner is requested in the query.

- Ensure there are no defaults in previous registrations, as the new registration will not be approved stating those reasons.

- In case GST registration application is rejected earlier, it is recommended to submit the application only with rectification for reasons mentioned in rejection letter.

- Select correct Jurisdiction of state and central while submission of GST application.

- In case of GST registration application for partnership firm or private limited company, additional care should be made for documentation of partnership firm or private limited company KYC documents.

Introduction of Aadhaar biometric verification at GST seva kendra

It is notified that starting based on the risk assessment of the dealer based on the application submitted by the dealer, the applicant may be required to complete biometric Aadhaar verification process at the GST seva kendra assigned to them.

- Bio metric verification is not mandatory for all applicants, it is only sent to those applicants identified based on the risk assessment by the GSTN.

- The process of biometric verification should be completed within 15 days from the date of generation of TRN, ARN will be generated only after the completion of Bio metric verification at GST seva kendra.

- If the verification is not completed with in 15 days from the date of generation of the TRN, the application will expire, and fresh application are required to be submitted.