Who is required to file an income tax return?

Earning an income is the best part of everyone’s life and it is the end result of efforts taken in terms of smart work, experience, and qualification. In India, income always comes with a “Pay tax” tag. The income tax department is also generous in giving exemption from filing income tax returns by certain persons based on the amount of income and nature of the person. In this article, we will give you an overview of who is required to file an income tax return.

What is an income tax return?

An income tax return is a form in which the income details and other particulars of income such as profit and loss accounts, assets, and liabilities are provided to the income tax department. With the development of a robust income tax portal, all functions related to income tax filing such as return filing, tax computation, tax payment, and data gathering are easy with few clicks.

An income tax return serves as a final input from the taxpayer regarding income earned, it is the statement of declaration of income with required particulars as per income tax rules.

There are different income tax forms available, taxpayers need to decide on which income tax form is required to be filed based on the nature of their income and the status of a person.

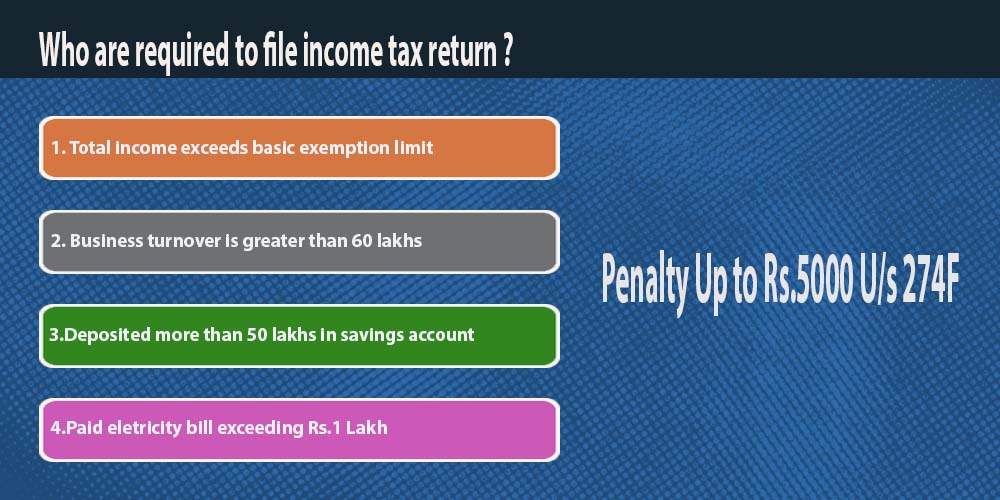

Who is required to file income tax returns?

Income tax return filing is mandatory for Private limited companies, public limited companies, partnership firms, and limited liability partnership firms irrespective of their turnover, profit or loss, etc. After private limited company registration, the company is required to file the income tax return for the financial year in which the registration certificate, and for other kinds of business except for proprietorship.

Filing of income tax returns for an individual is mandatory if their total income exceeds the basic exemption limit, for complete details on the basic exemption limit refer to income tax slab rates applicable for the financial year.

If the total income of an individual exceeds the basic exemption limit before giving deductions Under chapter VI-A and capital gains exemption (Except 54EE- Investment in startup mutual fund as declared by the government of India).

Being a resident and ordinary resident in India who is a beneficial owner or beneficiary in assets located outside India (including financial interest in any entity).

For individuals, if any of the following additional conditions is satisfied then an income tax return is required to be filed.

- Deposits in the current account are more than 1 crore, the deposits in all current accounts should be added together to determine the limit.

- Had paid an amount exceeding Rs.2 lakhs for foreign travel for self or others.

- Electricity bill during the financial year is above Rs.1 lakh.

- Turnover or gross receipts from the business is more than Rs.60 lakh.

- Turnover or gross receipts from the profession is more than Rs.10 lakh.

- TDS / TCS had reached Rs.25,000 and for senior citizens, the limit is Rs.50,000.

- Had deposited Rs.50 lakhs in savings account during the financial year.

What are the due dates for filing income tax returns?

Due dates U/s 139(1) – Regular due date without penalty.

For individuals, the due date for filing an income tax return is on the 31st of July of the following financial year, if tax audit is not applicable.

The due date for the individual is extended to 31st October when his accounts are required to be audited, or the firm in which he or she is a partner is required to get its accounts audited.

In case transfer pricing provision U/s 92E is applicable then the due date for the individual is on 30 November of the following financial year.

Loss under head capital gain and profits from business or professional can be carried forward only if filed within the regular due date.

Belated Return U/s 139(4) – extended due date with fine and other conditions

In the case where the taxpayer fails to file the return within the time limit as mentioned above U/s139(1), then the belated return can be filed up to 31st December of the succeeding financial year.

Conditions

- Carry forward of loss under head capital gains and profits and gains are not allowed.

- Revised returns cannot be filed.

- Loss can be carried forward if the application for condonation (forgiving) for the delay in filing the return is approved, condonation application should be filed within 6 years from the end of the relevant assessment year. the condonation application will be approved or rejected within 6 months from the end of the month in which the condonation application is filed.

Penalty for filing a belated return

If the total income is below Rs.5,00,000 the penalty is Rs.1000, in case the total income is Rs.5,00,000 and above then the penalty is Rs.5,000 U/s 274F.

How to revise income tax returns?

Income tax returns can be revised any number of times subject to genuine reasons if the first return for the financial year is filed within the regular due date U/s 139(1) until the 31st of December of the succeeding financial year or before completion of the assessment.

Once the revised return is filed, and verified the revised return substitutes the previously filed original return or revised return.

What happens if the income tax returns are not filed?

Where the person is required to file income tax returns and fails to file income tax returns, the assessing officer is empowered to issue a notice requiring the assessee to file an income tax return based on the notice. In case an income tax return is filed in response to the notice, penalties U/s.274F are required to be paid.

The income tax officer issues an income tax notice requiring the assessee to file the income tax return based on the data and information available to them, some of the information is annual returns filed by the financial institution, share brokers and depository, GST sales and purchase data, and third-party information, information regarding significant financial transactions such as data from state registration department, foreign exchange transactions, foreign travel, etc.